Heating, Cooling and Water-Heating Equipment

Taxpayers who purchase/purchased qualified residential energy-efficient property in 2012-2013 may eligible for a tax credit. The credit is equal to the full cost of the equipment up to the following caps:

- Advanced main air circulating fan: $50

- Natural gas, propane, or oil furnace or hot water boiler with an annual fuel utilization rate of 95 or greater: $150

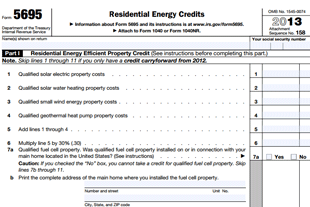

We have just uploaded the 2013 IRS tax credit form 5695. This form covers residential energy credits for homeowners who purchased qualifying equipment in 2013.

For more information about qualifying equipment and for a link to the form visit Rebates and Tax Credits.Current Rebate Status

For detailed information on what equipment qualifies for the 2014 NH Saves program visit our Heating and Air Conditioning Rebates

2022 NHSaves Rebates & Energy Star Tax credits

The graphs below are updated frequently by NHSaves.com to depict the remaining rebate funds for New Hampshire residents. We have also included links and documents to help our customers identify which equipment qualifies for rebates and tax credits. Please feel free to call our installation department if you need assistance with any rebate or tax credit forms.

Homeowners across New Hampshire still have time to take advantage of valuable federal savings, but the window is closing. The 25C Energy Efficient Home Improvement Credit will end after December 31, 2025, and A.J. LeBlanc Heating is encouraging anyone considering a new heat pump or HVAC system to act before the deadline.

NHSaves Program Options

NHSaves offers multiple paths depending on your utility, home details, energy usage, and sometimes household income. Below are three common program paths. Use the prequalifier tool to estimate which ones may fit your situation.